Indian Prime Minister Narendra Modi became the fourth world leader to meet US President Donald Trump within a month of his inauguration. The bonhomie was unmissable. Mr. Modi met Mr. Trump, Ms. Gabbard, Mr. Ramaswamy amongst others. Vice President Vance and DOGE architect, Elon Musk, even brought along their children to meet with Mr. Modi – this is rather sweet given Mr. Modi doesn’t have a family.

This meeting is hugely significant from many perspectives. India has largely ‘dodged’ the tariff bullet that Trump seems to be aiming at all trade partners, notably, China, Canada, Mexico and Europe. Vance spared Mr. Modi his lecture on democracy and freedom of speech which has rattled the European leadership this past week. Mr. Trump hailed the strengthening of ties between the world’s oldest democracy and the world’s largest democracy.

Trump and Modi launched, “U.S.-India COMPACT (Catalyzing Opportunities for Military Partnership, Accelerated Commerce & Technology) for the 21st Century”. Key initiatives include:

- Defense: US to sell strategic defence weaponry to India to protect itself against its neighbours (Pakistan and China are not pleased)

- Trade: More than double mutual trade to $500 billion

- Energy Security: US to collaborate with India on oil, gas and nuclear power

- Technology: Launch of US-India Trust (“Transforming the Relationship Utilizing Strategic Technology”) which will see India and US collaborate on critical technologies such as Artificial Intelligence, semiconductors, quantum computing, biotechnology and space

- Broader international co-operation on world trade, world peace and fight against terrorism

Stepping back 25 years

As per a Deutsche Bank report published in December 2025, from 2000 to 2024:

- US equities returned +4.9% per annum in real terms

- Chinese equities returned 4% per annum in real terms

- Gold returned 6.8% (this is an asset class that doesn’t even pay a dividend!)

- Indian equities have been one of the highest real returns amongst all developed and emerging markets a at 6.9% per annum

Peeking forward 25 years

The same Deutsche Bank report opines that out of 57 economies in their sample set – roughly evenly split between the top developed markets and the top emerging markets:

- 26 economies will see a decline in their working age population between 2025-29

- China: -225.8 million

- Japan: -18 million

- Korea: -12.2 million

- Russia: -11.7 million

- Italy: -10 million

- Germany: -8.6 million

- Spain: -7.8 million

- US will see a modest increase of 8 million people

- India will add 145 million workers

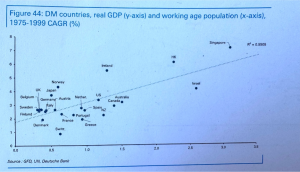

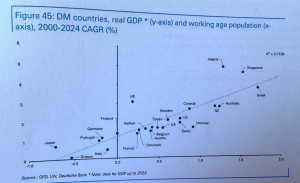

Correlation between growth in working age population and real GDP growth

As the charts above show, there is a strong correlation between the real GDP growth and the working age population of the country. This correlation translates to asset prices and thereby equity returns as well.

Conclusion

India has a strong domestic economic growth and demographic growth that has allowed its equity markets to deliver strong returns for the investors. India is uniquely positioned to benefit from strategic collaboration with the Trump administration over the next four years. India is furthermore uniquely positioned for the next quarter of a century.

India’s c. $4 trillion dollar economy is slated to grow GDP at 6%+ over the next many years. Its c.5trillion dollar equity markets are slated to add $10 trillion in value over the next decade or so.

However, US family offices and institutional investors have only 0-2% allocation to India. This needs a serious re-think.

Sachee Trivedi

17th February, 2025

Related Posts

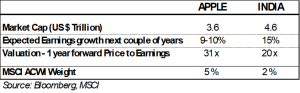

Taking a bite out of Apple

Apple is making news in India. Laurene Powell, Steve Jobs’s wife is visiting the holy city of Prayagraj. Prayagraj is a sleepy little town of 1.5 million people in the northern plains of India. Every...

US Exceptionalism & Exceptional India

The global stock markets have two bulls – the c.$55 trillion US market and the c.$5.5 trillion Indian stock market. For participating in both these markets, you pay 22 dollars for one dollar of earnings....